Flip Houses for Cash-Flow, but Hold a Few Cherries as Rentals to Build Long-Term Wealth

Flip Houses for Cash-Flow, but Hold a Few Cherries as Rentals to Build Long-Term Wealth

“My favorite holding period is forever.” -Warren Buffett

There are many ways to invest in real estate. You can build your portfolio by purchasing different types of properties: apartments, single-family homes, apartment complexes, commercial buildings, office spaces, raw land, tourist locations, and even foreign properties, to name a few.

As a strategy for investment, you have 3 primary ways to make money in Real Estate Investing:

- Use-change

- Cash-flow

- Appreciation.

When you buy a deferred maintenance house that can’t be financed conventionally and make the necessary repairs to bring the house up to FHA insurable condition, you have “used-changed” the property. Now it can be sold to an owner-occupant that can acquire long-term conventional financing. This, as you all know is the classic “Flip”.

However, most wealth building in investing Real Estate incorporates the other two profit centres: cash flow and appreciation. When you flip a house, you only take advantage of only one profit centre: “use change”. When you hold property you cash in on cash-flow and long-term appreciation. Here’s how.

Profit from Inflation

It is often said that landlords grow rich in their sleep because cash flow and equity increase over time. The average rate of inflation in the US for the past 50 years has been 4.1% annually. Therefore, if your rental income and the value of your investment property increase at this rate, your cash flow and equity will increase significantly over time. If there is a lien on the property you can still see a positive cash flow because inflation usually drives rental income up and loan payments are typically fixed.

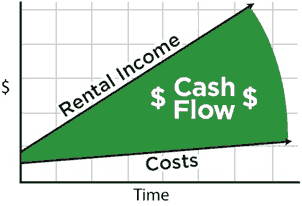

Cash flow increases over time. Rental income goes up faster than costs because loan payments are typically fixed.

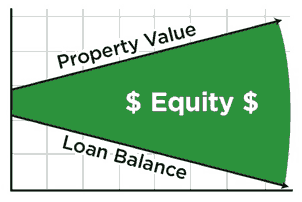

On the other hand, as equity increases over time, appreciation and loan payoff build equity.

Equity increases over time. Appreciation and loan payoff build equity.

In sum, inflation will yield profits as equity and rental income increases over time. Now think how much wealth you can build 10 years from now if you hold a few cherries as a rental; think how much wealth you can build 20 years from now… This is why Warren Buffett’s favourite holding period is forever.

The bottom line is: Flipping houses is a great source of steady cash flow for paying bills but now and then hold back a “cherry” as a rental property to add long-term wealth building to your Real Estate investing strategy.