by admin | Jan 4, 2024 | Fall in love with the profit, not the property

Fall in love with the profit, not the property

Building wealth is everybody’s goal in the real estate investing business. Many investors know that profit is the name of the game, but, like in everything else, things can sometimes go wrong. Here’s a tip for successfully managing your working capital in your investing projects. If you are a perfectionist, you will find this one helpful.

One of the most common mistakes in real estate investing is failing to work out a detailed rehab budget before a project begins. Take the time to define your rehab expenses and profit margin before you start the project — you will be thankful for it. Many investors, including experienced investors, omit this step and then realize they have spent more capital than expected. This ends up affecting the bottom line and leaves room for (often unpleasant) surprises.

This is a common problem in real estate investing and is usually the result of “falling in love” with the house, not the profit. Investors falling in love with the house often make multiple upgrades to the original rehab plan, and end up putting the profit into the rehab change orders. As an entrepreneur, think about profits first, but also make sure you have made the necessary improvements to make the house marketable.

Bottom line: Carve your rehab budget into stone before you start the project and stick to that number, no matter how much you fall in love with the house.

by admin | Jan 4, 2024 | Flip Houses for Cash-Flow, but Hold a Few Cherries as Rentals to Build Long-Term Wealth

Flip Houses for Cash-Flow, but Hold a Few Cherries as Rentals to Build Long-Term Wealth

“My favorite holding period is forever.” -Warren Buffett

There are many ways to invest in real estate. You can build your portfolio by purchasing different types of properties: apartments, single-family homes, apartment complexes, commercial buildings, office spaces, raw land, tourist locations, and even foreign properties, to name a few.

As a strategy for investment, you have 3 primary ways to make money in Real Estate Investing:

- Use-change

- Cash-flow

- Appreciation.

When you buy a deferred maintenance house that can’t be financed conventionally and make the necessary repairs to bring the house up to FHA insurable condition, you have “used-changed” the property. Now it can be sold to an owner-occupant that can acquire long-term conventional financing. This, as you all know is the classic “Flip”.

However, most wealth building in investing Real Estate incorporates the other two profit centres: cash flow and appreciation. When you flip a house, you only take advantage of only one profit centre: “use change”. When you hold property you cash in on cash-flow and long-term appreciation. Here’s how.

Profit from Inflation

It is often said that landlords grow rich in their sleep because cash flow and equity increase over time. The average rate of inflation in the US for the past 50 years has been 4.1% annually. Therefore, if your rental income and the value of your investment property increase at this rate, your cash flow and equity will increase significantly over time. If there is a lien on the property you can still see a positive cash flow because inflation usually drives rental income up and loan payments are typically fixed.

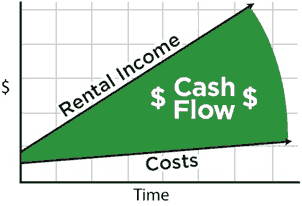

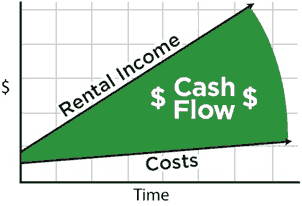

Cash flow increases over time. Rental income goes up faster than costs because loan payments are typically fixed.

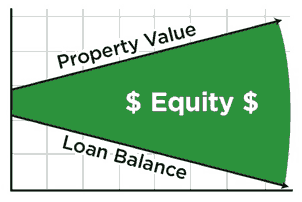

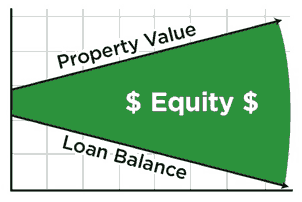

On the other hand, as equity increases over time, appreciation and loan payoff build equity.

Equity increases over time. Appreciation and loan payoff build equity.

In sum, inflation will yield profits as equity and rental income increases over time. Now think how much wealth you can build 10 years from now if you hold a few cherries as a rental; think how much wealth you can build 20 years from now… This is why Warren Buffett’s favourite holding period is forever.

The bottom line is: Flipping houses is a great source of steady cash flow for paying bills but now and then hold back a “cherry” as a rental property to add long-term wealth building to your Real Estate investing strategy.

by admin | Jan 4, 2024 | Many “Shots on Goal” is How to Score in Real Estate Investing

Many “Shots on Goal” is How to Score in Real Estate Investing

If you are looking into investing in real estate, you are likely trying to get the best deals in the least amount of time and effort. While there are guidelines to make a smart buying decision, “many shots on goal” is a key component to consistently making good buys.

The more opportunities you have, the more likely you will find a great bargain. Professional wholesale real estate buyers make 3 or more offers per day, 5 days a week, and hope to make 3 good buys a month. How many offers per day are you making? Whatever the number, it will be directly proportional to the number of great buys you make each month.

How to Make Your Offers More Effective

Although quantity is king, there are several things to keep in mind to make your offers more effective:

- Asking price: should be reasonable and ideally below other comparable properties in the market. By the way, if you feel too confident about the amount you offered, you probably offered too much. Make sure your offer is “just enough” to be considered.

- Repairs: Estimating repair costs is necessary before submitting an offer. This will also come in handy if you need to apply for private money or conventional financing.

- Sellers: Having a motivated seller who is willing to work with you (if you need to ask for an extension to close the property, for example) is a valuable advantage.

- Liens: Take the time to search for any liens the property may have. You can find this in public records or directly with the seller. Any liens found can be a game changer for your financing options and your profit margin.

At the end of the day, the only bad offer is the one that is never made. “Many shots on goal” is the key component to sustainable success in real estate investing. You will be surprised how many goals you can score.

by admin | Jan 4, 2024 | One Simple Tip to Make Your Rental Property Investments More Efficient

One Simple Tip to Make Your Rental Property Investments More Efficient

You have probably heard the old adage: “There are three things that matter in an investment property: location, location, location”. I can’t tell you how important this is for a healthy and manageable investment portfolio.

In this post, we are going to take a look at how location affects residential real estate investing.

You want to be buying houses in a very specific area, especially when you are buying, fixing and renting. As a hard money lender, I talk to real estate investors every day that are relatively new to the industry and are looking for a rental property loan. Sometimes they tell me about a house they are looking at in Orlando, or another one that they have in Tampa, and another one in Jacksonville… If this sounds like you, it’s time to re-evaluate your strategy. Here’s why…

The first rule about renting investment properties and building a nice portfolio is to look for houses in the same location. In my view, if you can’t stand in the center of where the houses are and, figuratively speaking, throw a rock and hit every house, you have the wrong plan. A rental house in Orlando, another one in Tampa, and another one in Jacksonville is a recipe for disaster.

Why should you buy rental houses in the same location?

There are 2 reasons to buy rental houses within close proximity:

- To know what you are buying – Buying properties within the same neighbourhood will help you understand the challenges and advantages of a specific investment property (appreciation, crime rate, etc).

- To create synergy between the properties – Houses within the same area are usually of the same kind. This can be beneficial in many cases. For example, you can hire a local handyman and he will know exactly how to fix maintenance issues in that kind of house. This is much more efficient than sending a handyman to a house in Orlando that was built in 1963 and another handyman to a house that was built in 2001 in Tampa, or Jacksonville.

by admin | Jan 4, 2024 | Know What to Look For in Your Residential Real Estate Investments

Know What to Look For in Your Residential Real Estate Investments

In the following weeks, we will be focusing on the art of purchasing wholesale investment properties. We will be covering topics such as how to find wholesale investment opportunities, negotiating, contracting, and closing.

Today, we will start with the first step, which is a discussion about specifically what type of properties to look for.

Here are a few, of the most important property features to will help you find the best rental properties:

- Single Family Homes

- Detached

- Conforming-zoning

- Established subdivision

- Standard Construction

- Deferred Maintenance “Handyman Special”

- Solid, middle class and up neighbourhoods with good appreciation prospects.

It’s often said that it’s much easier to find something if you know exactly what you are looking for. The same is true when you are trying to find wholesale investment properties. There are 2 primary strategies for real estate investors: One is to buy, fix, and sell (“flip”), and the other is to buy, fix, and rent. Previously, we analyzed the profit potential for these two strategies. Some houses are much better suited for long-term rentals and some are better suited for short-term flips.

Generally speaking, a long-term hold property should offer excellent prospects for appreciation and be in the type of neighbourhood that will attract quality tenants. Many beginning investors look at the cash flow from very cheap, small houses in distressed neighbourhoods and believe this is the most important characteristic of a rental. The problem with this strategy is, that small, cheap houses in distressed neighbourhoods do not appreciate at the rate of larger homes in better neighbourhoods. It is also difficult to attract and keep quality tenants in these small, cheap houses. Therefore, if you are looking for wholesale investment properties to hold as rentals focus on solid 3/2, 4/2 middle-income homes in quality areas. I like to focus on what I term “upward-transitional areas”. Try to buy quality homes cheap in C+ neighbourhoods that are in an upward transition to “B” and eventually “A” neighbourhoods. This specific type of property for a long-term hold strategy has created many real estate millionaires.

If your plan is to buy, fix and sell then focus your search in areas where homes are selling quickly. It is fairly easy to determine what the average days on market is in any specific zip code. Access to the MLS database, either directly or through a Realtor friend can quickly give you the data you need to find these fast-sell neighborhoods. I would recommend working with middle-income and up houses. Small, cheap houses in distressed neighborhoods are very hard to sell.